Snowmobile Sales Climb 9.2% for 2013-2014

As expected, a long snowy winter translated into increased sales

We’ve just come off an historic snow season – if you’re younger than 35 years of age! Well, certainly the most significant winter this century for sure. With that extra snowy winter you’d expect better than average snowmobile sales as a result. According to the International Snowmobile Manufacturers Association (ISMA), which keeps tabs on industry sales, the winter of 2013-2014 amped up sales by 12,505 units, an increase of 9.2 percent. This marks the fourth consecutive season that industry sales have increased by about nine percentage points.

The industry association also noted that the sled makers showed a more significant rise in OEM-branded parts, garments and accessories. There was a reported 20 percent increase in that area over last season. If you followed any of the sled maker’s end of year financial reports, you would have seen extremely strong and profitable PGA results from all four.

New sled models beget the latest in styled apparel to complement the sled’s design.

New sled models beget the latest in styled apparel to complement the sled’s design.Now, then, with this information in hand, it seems interesting that such results could not salvage the job of Arctic Cat’s Claude Jordan, the company’s president and chief executive officer. Sled sales at Cat were up, but other areas of the company fluctuated enough to cause a severe drop in stock prices. Indeed, the company’s stock fell from a high of more than US$60 per share to a 52 week low of just under US$32 per share. And that’s been the undoing of many a corporate CEO.

The Importance of Accessories and Apparel

So, now the formerly retired and previous ACAT top Cat Chris Twomey returns as the temporary fix until a replacement chief executive can be put in place.

Coming off the winter of 2013-2014, sled makers reported a 20 percent overall increase in the sales of OEM-branded parts, garments and accessories.

Coming off the winter of 2013-2014, sled makers reported a 20 percent overall increase in the sales of OEM-branded parts, garments and accessories.What does that mean? For one thing it shows that sled sales, while good overall, are not a panacea for corporate profit. Still, at least the new Cat man will step into a growing sled market. It will depend on future snows and long trending winters, of course, but ISMA notes that post winter snowmobile show visitations showed a 20 percent uptick over last year and reported early season sales were claimed to be good.

As for the actual retail numbers, the US market grew a percentage point to 35 percent of sales. That’s above last winter, but still down to the 2009-2010 season when the US claimed a 44 percent market share. Back then the “other” non-North American sled markets represented just 22 percent of the whole. Made up mostly of Scandinavia and Russia sales, this “other” marketplace grew to 36 percent last year and only dropped a percent back to 35 percent this year. So, that market is still very viable and readily explains the emergence of sleds like the 2015 Polaris 550 Indy Adventure 155 and 600 Voyageur; Ski-Doo’s series of ACE 900 powered Expeditions; Yamaha’s multi-purpose Venture models; and the updated Bearcats from Arctic Cat.

Today’s snowmobilers expect the latest in onboard technologies, like Cat’s latest gauge.

Today’s snowmobilers expect the latest in onboard technologies, like Cat’s latest gauge.The “other” sled market outside North America is a bit unique and very accepting of fan-cooled two-stroke sleds offered by Cat and Polaris that offer lower initial price and proven dependability. Still, we were a little surprised that the snowmobile industry’s sales remain as strong there as they did. With various international boycotts and such possibly affecting trade in some regions, we felt that sled sales might have been collateral damage. But, obviously not.

The US sled market bought about 300 fewer models than the “other” market, but overall market share of 35 percent is the same as the Scandinavian and Russian markets.

2015 Ski-Doo 800 Summit X 174 with T3 Review + Video

One area we figure that will remain consistent in the US and Canada is the mountain or deep powder segment. A simple browsing of a sled maker’s 2015 brochure will point out how important that market is. Check out the attention that Ski-Doo places on it as witnessed by the T-3 package for the Summit. So far Polaris rides on its Pro-RMK series, but we seriously expect either an all-new or upgraded new Polaris mountain model by the 2016 season. Check out the AXYS chassis and new 800cc engine of the 2015 Rush and Switchback. Where might such improvements be headed?

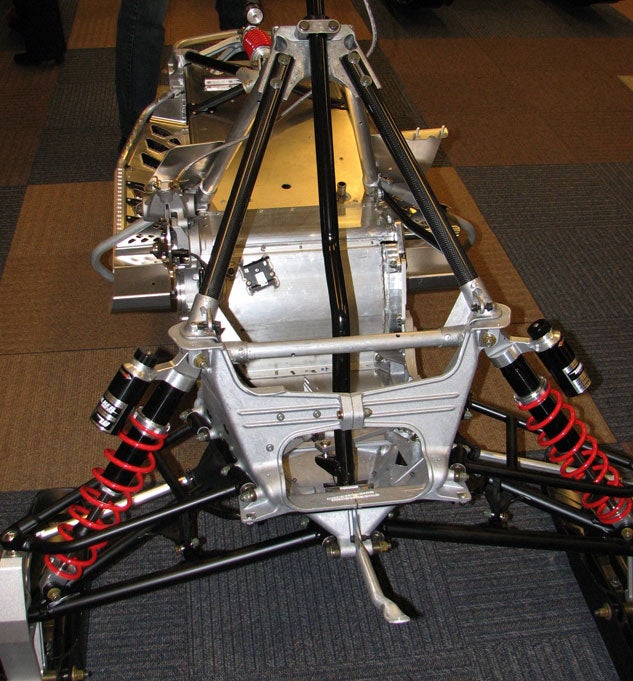

A successful winter encouraged Polaris to go ahead with the AXYS chassis, the base for the new Rush and Switchback models.

A successful winter encouraged Polaris to go ahead with the AXYS chassis, the base for the new Rush and Switchback models.Even Yamaha opted into the deep snow segment, albeit with an 1100cc four-stroke in a Cat ProClimb chassis. As for Cat, we suspect that some marketing inattention and over reliance on the new “M” series caused Cat to lose serious sales to both Ski-Doo and Polaris. We also feel reasonably informed that Cat’s engineering group knows what to do to regain its claw hold on the mountain segment. With the change in upper management, maybe more engineering dollars will flow uphill to a new mountain Cat.

Of course, we can’t disrespect the trail segment as Polaris has placed a bet that it will grow enough to justify developing the AXYS short track and crossover models. Ski-Doo plays here as well and continues to do well. The Yamaha-Arctic Cat combination helped breath sales into Yamaha dealerships and we expect that to continue. Frankly, Yamaha may be the better option as its Vipers use familiar Yamaha clutching with its Yamaha-power in the Cat chassis.

Viper sales gave new life to Yamaha dealerships and the hope was that colorful “limited editions” would boost 2015 sales.

Viper sales gave new life to Yamaha dealerships and the hope was that colorful “limited editions” would boost 2015 sales.Looking at sled sales rebounding, we are encouraged and we also agree with ISMA that overall sled registrations increased. We suspect that many snowmobilers may have renewed old sled stickers as they put their older sleds back on the trail. The numbers just aren’t dramatic enough for us to conclude that the industry is seeing a serious rebound in users or, especially, new riders. Sled registrations have been at these levels – off and on – for decades.

2015 Polaris 800 Rush Pro-X Review + Video

Based on ISMA numbers, we are very bothered by the fact that only 55 percent of the registered total belongs to clubs or associations. That means that 45 percent of those snowmobiling are getting a free ride!

The snowmobile industry reported that miles ridden by snowmobilers this past winter were up 50 percent, which makes the role of the trail groomer even more important to the sport.

The snowmobile industry reported that miles ridden by snowmobilers this past winter were up 50 percent, which makes the role of the trail groomer even more important to the sport.There was a lot more riding done in the winter of 2013-2014 as ISMA research indicates that miles ridden by snowmobilers this past winter were up 50 percent versus the previous winter! One way the snowmobile industry can help itself is to promote the use of trails and support those who build and maintain the trail systems. Let’s not forget that snowmobiling generates more than US$30 billion of economic activity in the United States and Canada. That’s what a strong and snowy winter can do for the economy and the snowmobile industry.

Looking ahead to the next winter season, the snowmobile manufacturers remain cautiously optimistic. After all, the youngest of the four snowmobile manufacturers is just short of 50 years in the business, which means that each sled maker has been through these highs and lows a few times before. Cautiously optimistic we accept. Another winter like the one of 2013-2014 can only bring continued good news to snowmobilers and the snowmobile industry as a whole.

| Estimated Snowmobile Sales | |||||

| Region | 2013-2014 Sleds Sold (estimated) | 2012-2013 Sleds Sold (estimated) | 2011-2012 Sleds Sold (estimated) | 2010-2011 Sleds Sold (estimated) | 2009-2010 Sleds Sold (estimated) |

| United States | 54,028 (35%) | 48,536 (34%) | 48,689 (38%) | 51,796 (42%) | 49,200 (44%) |

| Canada | 48,758 (31%) | 44,022 (30%) | 40,165 (31%) | 40,878 (33%) | 37,600 (34%) |

| Europe & Russia & other | 54,320 (35%) | 52,043 (36%) | 40,233 (31%) | 30,389 (25%) | 24,300 (22%) |

| Total | 157,106 | 144,601 | 129,087 | 123,063 | 111,100 |

Your Privacy Choices

Your Privacy Choices